As a result, the bank debits the amount against such dishonored cheques or bills of exchange to your bank account. This way, the number of items that can cause the difference between the passbook and the cash book balance is reduced. And as a result, it gets easier to ascertain the correct balance in the balance sheet. Book transactions are transactions that have been recorded on your books but haven’t cleared the bank.

Get in Touch With a Financial Advisor

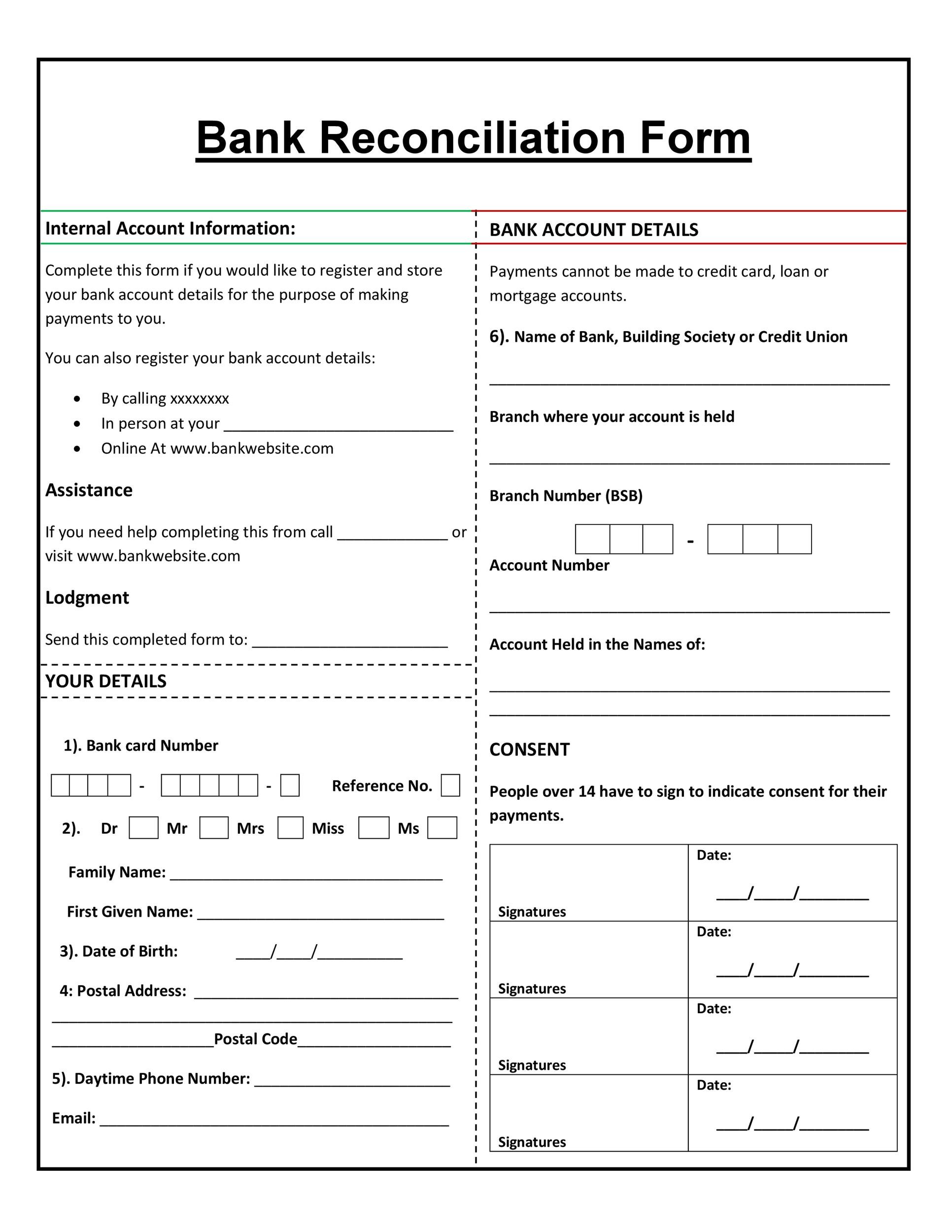

The balance recorded in the passbook or the bank statement must match the balance reflected in the customer’s cash book. It is up to you, the customer, to reconcile the cash book with the bank statement and report any errors to the bank. Discrepancies in bank reconciliations can arise from data processing errors or delays and unclear fees at the bank. Unpredictable interest income may also be a challenge when calculating financial statements, which can lead to challenges during a bank reconciliation.

What is a bank reconciliation statement?

This can include large payments and deposits or notifications of suspicious activity from your bank. In these situations, it’s a good idea to perform an immediate reconciliation. Bank provides various services to its depositors such as printing checks, processing NSF checks and collecting notes receivables etc.

Step 1. Choose Your Method for Reconciliation

This includes everything from major fraud and theft to accounting miscalculations, insufficient funds, and incomplete or duplicated payments. Compare the business’s financial records to the bank statement to spot the errors. This can be accomplished by matching transactions, and then adding or deducting any transactions that do not align to balance the total amounts. The more frequently you do a bank reconciliation, the easier it is to catch any errors. Many companies may choose to do additional bank reconciliations in situations that involve large sums of money or that show unusual financial activity.

- As a result, the balance shown in the bank passbook would be more than the balance shown in your company’s cash book.

- The items therein should be compared to the new bank statement to check if these have since been cleared.

- Do you want to test your knowledge about bank reconciliation statement?

- More specifically, a bank reconciliation means balancing your bank statements with your bookkeeping.

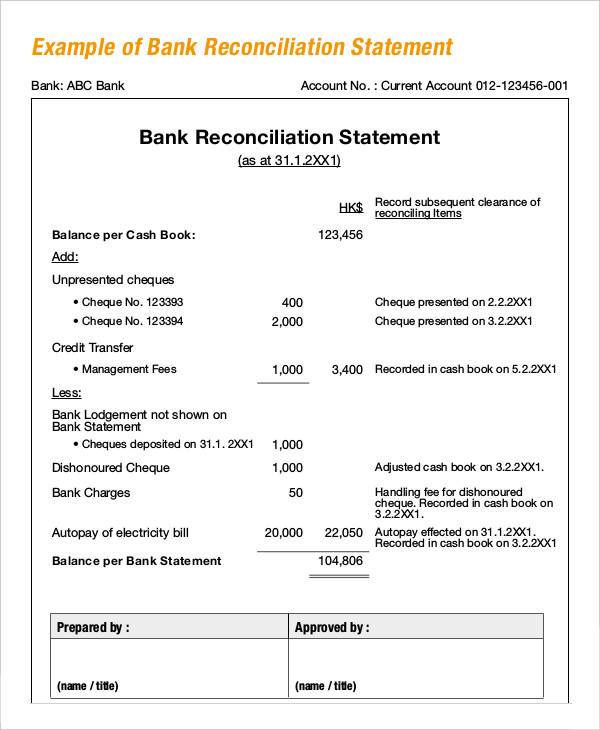

Steps in preparing a bank reconciliation statement:

We’ll explore the definition of bank reconciliation, why it’s important, and a step-by-step process for performing bank reconciliations. We’ll also look at common sources of discrepancies between financial statements and bank statements to help you identify fraud risks and errors. Performing regular bank reconciliations is key to keeping on top of your company’s financial health and paving the way for sustainable business growth.

First, check your two cash balances

The amount of these checks are recorded by the depositor when they are issued but no entry is made by the bank in his account until the checks are actually presented and payment received by the creditor. Unpresented checks, therefore, cause a difference between the balance in company’s accounting record and the balance as per bank statement for the period concerned. The cash account balance in an entity’s financial records may also require adjusting in some specific circumstances, if you find discrepancies with the bank statement. In these cases, journal entries record any adjustment to the book’s balance. After fee and interest adjustments are made, the book balance should equal the ending balance of the bank account. We strongly recommend performing a bank reconciliation at least on a monthly basis to ensure the accuracy of your company’s cash records.

This usually happens when deposits are made after the bank’s cut-off time. Bank reconciliation statements safeguard against fraud in recording banking transactions. They also help to detect any mistakes in cash book and bank statement. Every business has different transactions and errors, so it’s helpful to think of the formula as a tool why choose a career in accounting to guide you through the bank reconciliation process. This will ensure your unreconciled bank statements don’t pile up into an intimidating, time-consuming task. If you use the accrual system of accounting, you might “debit” your cash account when you finish a project and the client says “the cheque is going in the mail today, I promise!

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Then, you make a record of those discrepancies, so you or your accountant can be certain there’s no money that has gone “missing” from your business. Compare your personal transaction records to your most recent bank statement. First, make sure that all of the deposits listed on your bank statement are recorded in your personal record. If not, add the missing deposits to your records and your total account balance. The goal of bank account reconciliation is to ensure your records align with the bank’s records. This is accomplished by scanning the two sets of records and looking for discrepancies.

They often appear as a reconciling item because banks notify customers of the amount only through the bank statement. After all adjustments, the ending balance of the cash book should equal the bank statement. Finally, document the entire reconciliation process, at a minimum capturing who prepared and reviewed the reconciliation and when.

You can do so by comparing the checks issued in your accounting record with the checks honored as per your bank statement. If your accounting record shows that a check has been issued and your bank statement does not show a corresponding entry for that check, it means that it is an outstanding or unpresented check. Banks provide various services to its customers and deduct service charges from their accounts.