By employing these techniques, businesses can ensure their financial data accurately reflects their economic activities, thereby aiding strategic decision-making. It keeps businesses on track of their financials and optimizes operations by checking if all financial activities are safe. Leveraging a single hub for cost reconciliation is an essential component of any effective accounting strategy. See also the definitions of Adjusted EBITDA, Free Cash Flow, Adjusted EBITDA margin, and Net Debt under the Supplemental Disclosure Regarding Non-GAAP Financial Information section in this release. Cash provided by operating activities was $102.8 million, compared to $96.2 million in the prior year period primarily due to the increase in political revenues, largely offset by a decrease in broadcast revenue. Free Cash Flow was $73.3 million, compared to $67.7 million in the prior year period.

Key Principles of Cost Reconciliation

We will also provide some tips and best practices for reconciling costs effectively and efficiently. This means that the processes and methods used to verify and resolve the cost discrepancies or inconsistencies should be constantly evaluated and optimized to ensure accuracy, efficiency, and effectiveness. Continuous improvement can help reduce the errors, delays, and disputes that may arise from inaccurate or inconsistent cost data.

Why accounting reconciliation matters for businesses

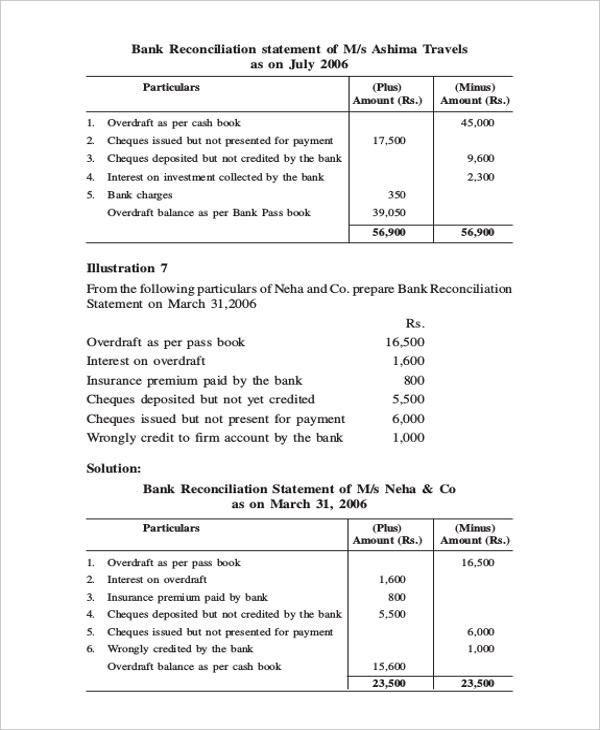

Under the non-integral system of accounting, which maintains cost accounts and financial accounts separately, the documents used to ascertain the amount of charged expenditure are the same. Thus, reconciliation identifies and accounts for the items which have led to the difference in working results as shown by cost accounts and financial accounts. Reconciliation represents the process of tallying the working results or profits as shown by cost accounts with those of financial accounts. The costs per equivalent unit are used to value the units in the ending inventory and the ones that have been moved to the next process. When calculating the equivalent units with the weighted average method and the FIFO method we will end up with a different quantity, using the same data.

Cost Reconciliation: How to Verify and Resolve the Discrepancies or Inconsistencies in the Cost of a Project or Process

So from our example above, we have 4925 equivalent units of production using the weighted average method. If our total cost of our beginning WIP inventory was $1,000 and we added $10,000 during the period. RIB Candy is a versatile estimating, planning, and project control solution perfectly suited to the complexity and scope of construction CVR.

The main purpose of reconciling cost and financial accounts is to identify and correct any discrepancies between the two sets of accounts. This helps to ensure that the profit figure shown in financial accounts is accurate and consistent with the company’s actual performance, and that any non-recurring or unusual items are excluded from the profit figure. Cost reconciliation is the process of aligning and verifying the total costs incurred in the production of goods or services with the corresponding output or units produced. It is a crucial step in cost accounting that ensures the accurate reporting of production costs and the efficient management of resources. Technology minimizes project risks and errors by eliminating manual calculations and data entry while improving efficiency through automated workflows. Construction management and cost management software solutions allow businesses to scale their operations by providing the real-time data collection and analysis capabilities needed to manage millions of cost elements.

- Organizations that master cost reconciliation minimize the risk of non-compliance penalties and reputational damage.

- Organizations must establish robust data collection mechanisms, leveraging modern accounting software and automated processes.

- This can help avoid confusion, ambiguity, and duplication of cost data among the parties involved in the cost reconciliation process.

- According to a survey conducted by the Association of Certified Fraud Examiners (ACFE), financial statement fraud constituted 9% of all reported fraud cases in 2022.

The chosen option should be aligned with the project or process objectives, requirements, and expectations. For example, if the inconsistency is due to a defect in the product, the best option may be to repair, replace, or refund the product depending on the severity of the defect and the customer satisfaction. Prepare a schedule of all income and profit credited to the profit and loss account but excluded from cost tips for claiming job accounts. Financial accounts offer depreciation based on the diminishing balance (written-down value) method or original cost method. 4800 units × $2.09 plus the $658 of costs incurred for the beginning inventory that was transferred out. Access Coins, our powerful construction management software, includes a module devoted to calculating and reporting CVR which cuts days of work from the CVR reporting process.

Adjusted EBITDA is among the primary measures used by management for the planning and forecasting of future periods, as well as for measuring performance for compensation of executives and other members of management. We believe this measure is an important indicator of the Company’s operational strength and performance of its business because it provides a link between operational performance and operating income. It is also a primary measure used by management in evaluating companies as potential acquisition targets.

The variances should be calculated and expressed in both absolute and percentage terms, and should be classified as favorable or unfavorable. The reasons for the variances should be identified and explained, such as changes in prices, volumes, efficiency, or quality. The devil lies in the details, and cost reconciliation demands meticulous attention to granularity. Whether tracking departmental expenditures or dissecting project-specific costs, accuracy is paramount. Organizations must establish robust data collection mechanisms, leveraging modern accounting software and automated processes.

In short, while it might require some effort, regular reconciliation is well worth it for the peace of mind and accuracy it provides. Spotting discrepancies manually can be like finding a needle in a haystack. That’s where conditional formatting comes in—it visually highlights differences, so you don’t have to squint at rows of data. This can help you total amounts that meet certain criteria, such as all transactions on a particular date. For instance, if you’re looking to match transaction amounts, VLOOKUP can pinpoint where differences occur. In the current business landscape, the ability to monitor and manage expenses efficiently is not…

CVR reports allow clients, project managers, and other stakeholders to make timely course corrections that keep projects in the black. When diving into cost value reconciliation, you’re essentially looking at a detailed analysis of the variations between recorded values and actual expenses. This process involves various elements and steps, each fundamental to unveiling an accurate financial depiction.